When can you start receiving your pension?

Our Scheme's Normal Retirement Age (NRA) is 65. You have some flexibility regarding when you start to take your pension.

Taking your pension early

In the UK, you can begin to receive your pension at age 55. However, the government plans to increase this age to 57 starting from April 2028. You can continue working and still start receiving your pension.

Although the law allows it, you are not automatically entitled to receive your Scheme pension before your NRA. You might have to seek permission from either our Trustee and/or the Company. Additionally, other limitations may prevent our Scheme from paying your pension early.

Taking your pension early is likely to mean that you will be receiving it for longer, therefore the pension you receive will be less than if you wait until your NRA.

If you are seriously ill, the rules are a little different. You might be eligible to begin receiving your pension before reaching the age of 55. Additionally, you could be entitled to a larger pension compared to someone who is in good health and opts to take their pension early.

Leaving your pension invested until a later date

Lots of people are thinking of working longer. If you want to work past age 65, our NRA may be too early for you to start receiving your pension. You can ask our Trustee to defer the payment of your pension until a later date.

If you choose to defer your pension, and our Trustee agrees, it will likely be more than what you would have received at your NRA. This is because it's assumed you won't be receiving it for as long. Current UK law requires you to start receiving your pension on or before you reach age 75.

How much will you get?

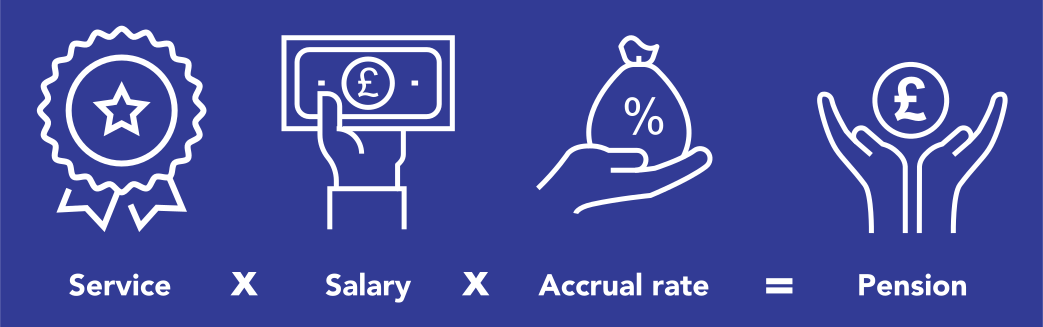

Your pension is determined by a mathematical formula, offering more predictability in the amount you will receive compared to other types of pension arrangements.

However, the calculation of your pension maybe more complex than the illustration above. Things that can affect the calculation of your pension include:

- Periods when you worked on a part-time basis;

- Absences from work (although normally, short periods relating to illness or sickness have no effect on your pension);

- If you have transferred benefits from another arrangement into your pension.

Sometimes, you may have varying accrual rates or salary bases for different periods of your Scheme membership. You can find more information about how your pension (and other benefits) are calculated in the Member Booklet, which is available to view, download or print in the Documents section.

What choices do you have at retirement?

Shortly before you reach your Normal Retirement Age (NRA), you’ll receive a retirement pack; this will contain all the documentation needed to start receiving your pension.

If you’re considering receiving your pension earlier or later than your NRA, you’ll need to request a retirement quotation. For details of how to do this, take a look at our guide: Get a retirement quotation

Exchanging some of your pension for a one-off cash sum

In most circumstances, you'll be offered the option to exchange some of your pension for a one-off cash sum, normally paid tax-free. This amount could be as much as 25% of the total value of your pension. In some cases, the amount of pension you can exchange for a cash sum will be restricted, resulting in a smaller cash sum.

If you exchange some of your pension for a one-off cash sum, it will not affect the benefits payable to your loved ones when you die.

Trivial commutation

If your pension is very small, you may have the option to exchange all of your benefits within our Scheme for a single cash sum, often referred to as trivial commutation.

Currently, to be offered this option, the total value of your Scheme benefits must be less than £30,000. Other restrictions also apply, including the value of any other pension savings you may have. Please note that a trivial commutation cash sum is liable to tax, although normally 25% will be tax-free. Additionally, taking a trivial commutation cash sum will mean no benefits will be payable to your loved ones following your death.

Options if you have paid Additional Voluntary Contributions (AVCs)

If you have paid AVCs, these will provide another pot of cash to spend on additional benefits. You may choose to use this to purchase additional pension, or take it as some or all of your AVCs as part of a one-off cash sum.

Normally, any retirement quotation you receive will include details of your options relating to any AVCs you've previously paid into the Scheme.

Do you want greater flexibility?

For some, having greater flexibility around how they use their pension savings is important. If this is you, transferring your benefits out of our Scheme may be something you want to consider. This won't be right for everyone and should be considered really carefully.

You can find out more about how to obtain a transfer quote in the Get a transfer out quotation entry within the Help and guidance page.

Before any transfer payment can be made, you may be required to demonstrate that you have received the appropriate advice from an IFA. The IFA must be sanctioned by the Financial Conduct Authority (FCA). You'll for information about finding an IFA with the Help and guidance page.

How to pay tax on your pension

How your contributions are taxed

Contributing to a pension scheme is normally the most tax-efficient way to save for your retirement. Generally any contributions paid, including any AVCs, are deducted from your gross salary before tax is deducted. However, there are two limits which you need to be aware of.

The Annual Allowance

This is the maximum you can contribute to all your pension savings in any single tax year. It is currently set at £60,000. For a Defined Benefit scheme such as our Scheme, it is more complicated as it is based on how much the Capital Value of the benefits you have built up in our Scheme has increased.

The Money Purchase Annual Allowance

This limit only impacts those who have started to access their retirement benefits and want to continue to contribute to a Defined Contribution (DC) scheme.

For more information on these allowances please refer to https://www.gov.uk/tax-on-your-private-pension/annual-allowance.

How your pension is taxed

Once you start receiving your pension, it will be taxed as income. HM Revenue and Customs (HMRC) will advise what tax code should be applied to your pension. Your tax code will take account of:

- Any other pensions you are receiving;

- Any other taxable income you're receiving (for example, if you start receiving your pension whilst continuing to work); and

- Any State Pension (or other benefits) you're receiving.

What happens to your pension if you leave Pensionable Service?

On ceasing to be an Active member if you do not immediately start receiving your pension you become a Deferred member.

As a Deferred member, you won't accumulate any additional pension. However, the pension you've already built up might be subject to increases (or revaluation) from the time you stop being an Active member until you start receiving your pension. Your pension may be made up of several tranches, each increasing using a different revaluation basis.

Don't forget, if you're age 55 or over, or are seriously ill, you may be able to start receiving your pension immediately (see 'Taking your pension before your NRA' above).

You will receive a Statement shortly after ceasing to be an Active member confirming what pension you have built up. You may not subsequently receive any further Statements automatically until you are close to your NRA, but you can request updates. Take a look at our guide: Get a retirement quotation for details of how to request an update of how much pension you'll receive at retirement.

What gets paid if you die

None of us like to think about dying, but its good to know what your loved ones might receive from our Scheme if the worst happens.

Lump sums

If you're yet to start receiving your pension, it is likely that a lump sum will be payable. The actual amount payable depends on whether you are an Active or Deferred member. Your Annual Benefit Statement or Leaving Service documentation will explain what is payable.

If you're already receiving your pension, a lump sum may also be payable. This will depend on how long you have been receiving your pension.

Currently, our Trustee decides who will receive any lump sums that become payable. This means that it doesn't form part of your estate and is not normally liable to Inheritance Tax. It is important, when this decision is made, that your wishes are taken into account. Therefore, we urge you to regularly update your Expression of Wish. Our guide: Tell us who you’d like to receive any benefits from our Scheme if you die explains how to do this.

Dependents' pensions

In addition to a lump sum, pensions may be payable to certain individuals. Who can receive these pensions is set out in our Scheme Rules. Normally, a pension may be payable to:

- Your spouse or civil partner; and

- Your children - but only until they reach adulthood.

In addition, pensions may be payable to other individuals who are financially dependent on you.

What happens to your pension if you get divorced/end a civil partnership

If your getting divorced or ending a civil partnership, your pension is, in effect, another asset, similar to any other savings you may have accumulated. So, you'll need to include the value of your pension in any financial settlement you agree. There are three ways this can be achieved:

- Offsetting - this is the simplest approach and basically means you keep your entire pension, and in return, agree to give up another asset of equivalent value.

- Sharing - with this approach, you agree to give up a portion of your pension to your ex-spouse or ex-civil partner. This is normally achieved by transferring the appropriate value to another arrangement.

- Earmarking - possibly the most complicated option. Once you decide to take your pension, a portion of it is paid to your ex-spouse or ex-civil partner. Unlike pension sharing, your entire pension entitlement remains within our Scheme and, more crucially, your ex-spouse or ex-civil partner can only start to receive their pension at the same time you start receiving yours.

To be able to give you the appropriate legal advice, your solicitor will need information about our Scheme and the pension you have built up. Equiniti, our Scheme Administrator, can provide you with a Divorce Pack which contains all the information they'll need, including any costs you and/or spouse or civil partner will need to pay. Details of how to obtain a Divorce Pack can be found in our guide: Get a divorce pack